51% (double spend) Attack

51% attack refers to an attack on a blockchain by a group of miners controlling more than 50% of the network’s mining hashrate, or computing power. The attackers would be able to prevent new transactions from gaining confirmations, allowing them to halt payments between some or all users. They would also be able to reverse transactions that were completed while they were in control of the network, meaning they could double-spend coins.

BREAKING DOWN ‘51% Attack’

Bitcoin and other cryptocurrencies are based on blockchains, a form of distributed ledger. These digital files record every transaction made on a cryptocurrency’s network and are available to all users – and the general public – for review, meaning that no one can spend a coin twice. (So-called “private blockchains” introduce permissions to prevent certain users of the general public from seeing all the data on a blockchain.)

As its name implies, a blockchain is a chain of blocks, bundles of data that record all completed transactions during a given period of time (for bitcoin, a new block is generated approximately every10 minutes). Once a block is finalized – “mined,” in the jargon – it cannot be altered, since a fraudulent version of the public ledger would quickly be spotted and rejected by the network’s users.

However, by controlling the majority of the computing power on the network, an attacker or group of attackers can interfere with the process of recording new blocks. They can prevent other miners from completing blocks, theoretically allowing them to monopolize the mining of new blocks and earn all of the rewards (for bitcoin, the reward is currently 12.5 newly-created bitcoins, though it will eventually drop to zero). They can block other users’ transactions. They can send a transaction, then reverse it, making it appear as though they still had the coin they just spent. This vulnerability, known as double-spending, is the digital equivalent of a perfect counterfeit and the basic cryptographic hurdle the blockchain was built to overcome, so a network that allowed for double-spending would quickly suffer a loss of confidence.

Changing historical blocks, transactions locked in prior to the start of the attack, would be extremely difficult even in the event of a 51% attack. The further back the transactions are, the more difficult it would be to change them. It would be impossible to change transactions prior to a checkpoint, past which transactions are hard-coded into bitcoin’s software.

On the other hand, a form of a 51% attack is possible with less than 50% of the network’s mining power, but with a lower probability of success.

ZenCash

The Zen network was the target of a 51% attack on 2 June at approximately 8:26 pm EDT (03 June 00:26 hrs UTC). The Zen team immediately executed mitigation procedures to significantly increase the difficulty of future attacks on the network. Sequence of events:

6/2 (2026 EDT) – Received warning of potential attack from one of our pool operators

6/2 (2034 EDT) – Immediately initiated investigation and evaluated hash power distribution

6/2 In parallel, contacted exchanges to increase confirmation times

6/2 (2042 EDT) – Investigation showed that the suspect transaction was a double spend

6/3 Additional forensics and jointly investigating with the affected exchange

6/3 (0900 EDT) – Released this official announcement about the attacks

6/4 (1150 EDT) – Released new finding on the investigation

6/6 (0946 EDT) – Co-founder, Rob Viglione, issued statement responding to the attacks and dispel misconceptions

All Equihash-based networks are exposed to an influx of new Equihash power and therefore the best short-term mitigation strategy was to recommend that all exchanges increase their minimum required confirmations to at least 100.

At the time of the attack the Zen network hash rate was 58MSol/s. It is possible that the attacker had a private mining operation large enough to conduct the attack and/or supplement with rental hash power. Net hash rate is derived from the last mined block and therefore live hash rate statistics are not available.

The suspect pool address is znkMXdwwxvPp9jNoSjukAbBHjCShQ8ZaLib. Between blocks 318165 and 318275, the attacker(s) caused multiple reorganizations of the blockchain, reverting 38 blocks in the longest reorganization. In block 318204 and 318234 the attacker(s) performed double-spend attacks.

Note: Bittrex had transaction confirmation of 150 prior to the attack and therefore was not the target of the attack.

14.06 2018 ZenCash Team releases a proposal to modify Satoshi Consensus to enhance protection against 51% attacks https://zencash.com/assets/files/A-Penalty-System-for-Delayed-Block-Submission-by-ZenCash.pdf

Bitcoin Gold

Verge

Ghash.io

The mining pool ghash.io briefly exceeding 50% of the bitcoin network’s computing power in July 2014, leading the pool to voluntarily commit to reducing its share of the network. It said in a statement that it would not reach 40% of the total mining power in the future.

Krypton and Shift

Krypton and Shift, two blockchains based on ethereum, suffered 51% attacks in August 2016.

34% Attack

The tangle, a distributed ledger that is fundamentally distinct from a blockchain but designed to accomplish similar goals, could theoretically succumb to an attacker deploying over a third of the network’s hashrate, referred to as a 34% attack.

SELFISH MINING (BLOCK-WITHHOLDING)

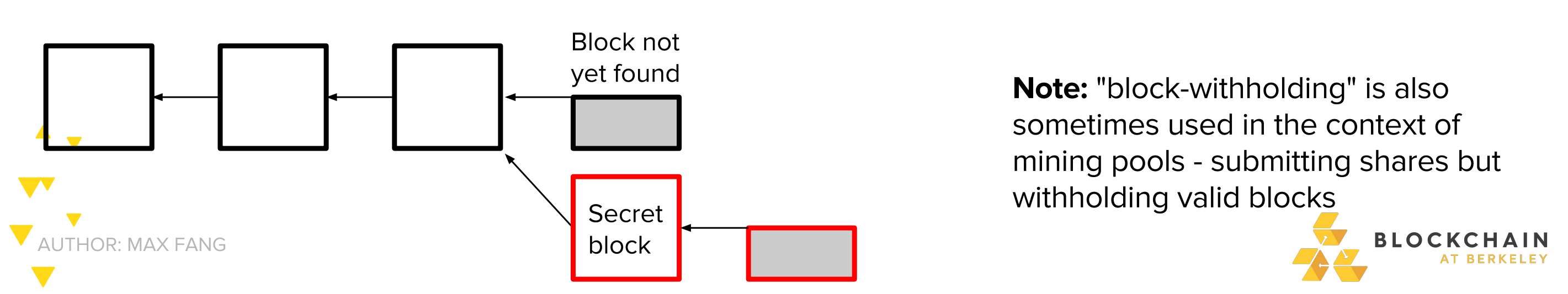

You are a miner, suppose you have just found the block. -Instead of accouncing block to the network and receiving reward, keep it secret

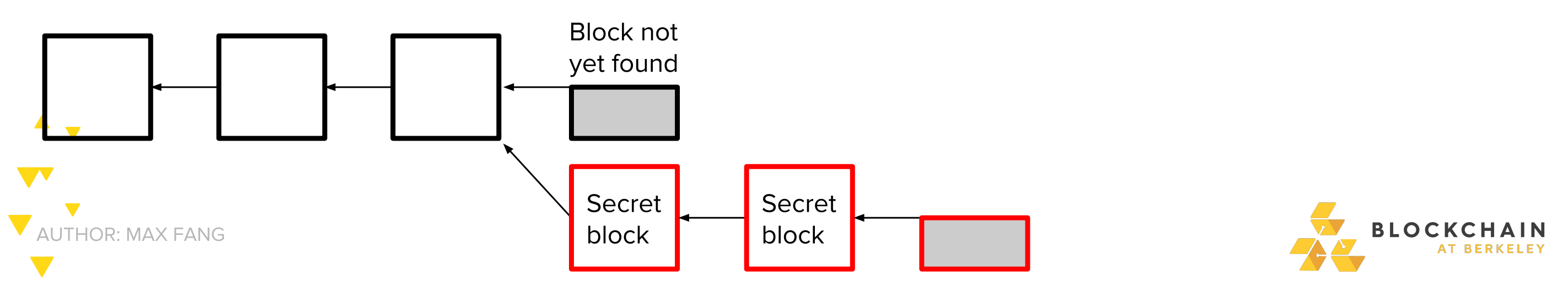

- Try to find two blocks in a row before the networks finds the next one

This is called selfish mining or block-witholding

Note: “block-witholding” is also sometimes used in the context of mining pools -submitting shares but witholding valid blocks

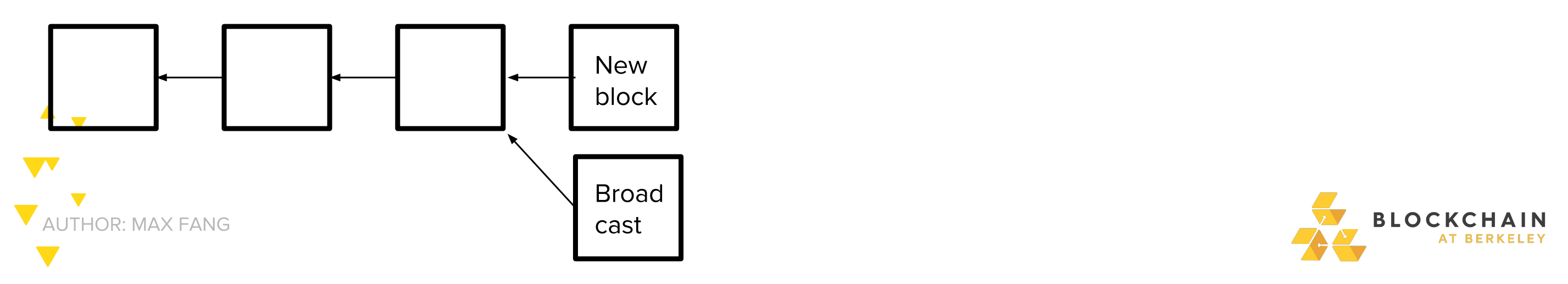

If you succeeded in finding a second block, you have prevailed

- Network still believes it is mining on the longest prof of work chain -You continouse to mine on your own chain

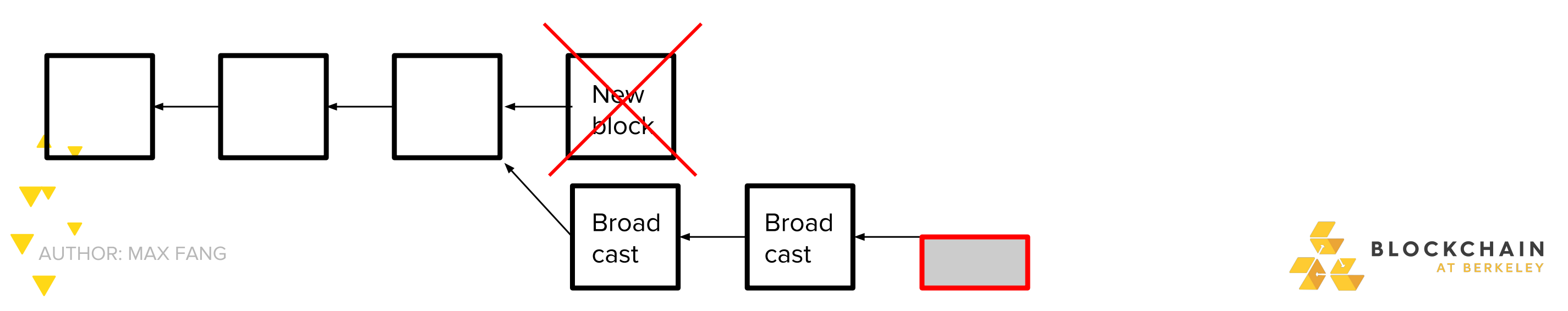

If the network find a block, you broadcast your two secret block and make the network invalid

- While network was working on the invalid block, you got a bunch of time to mine by yourself… for free! -Free time mining on network => higher effercive proportion of hashrate => higher expected profits!

But what of the network found their new block before you could find a second one? Race to propagate!

- If on average you manage to tell 50% of the network about you block first:

- Malicious strategy is more profitable if you have >~25% mining power _ If you have >~33% mining power, you can lose the race every time and malicious strategy is still more profitable!

- (actual math omitted due to complexity)

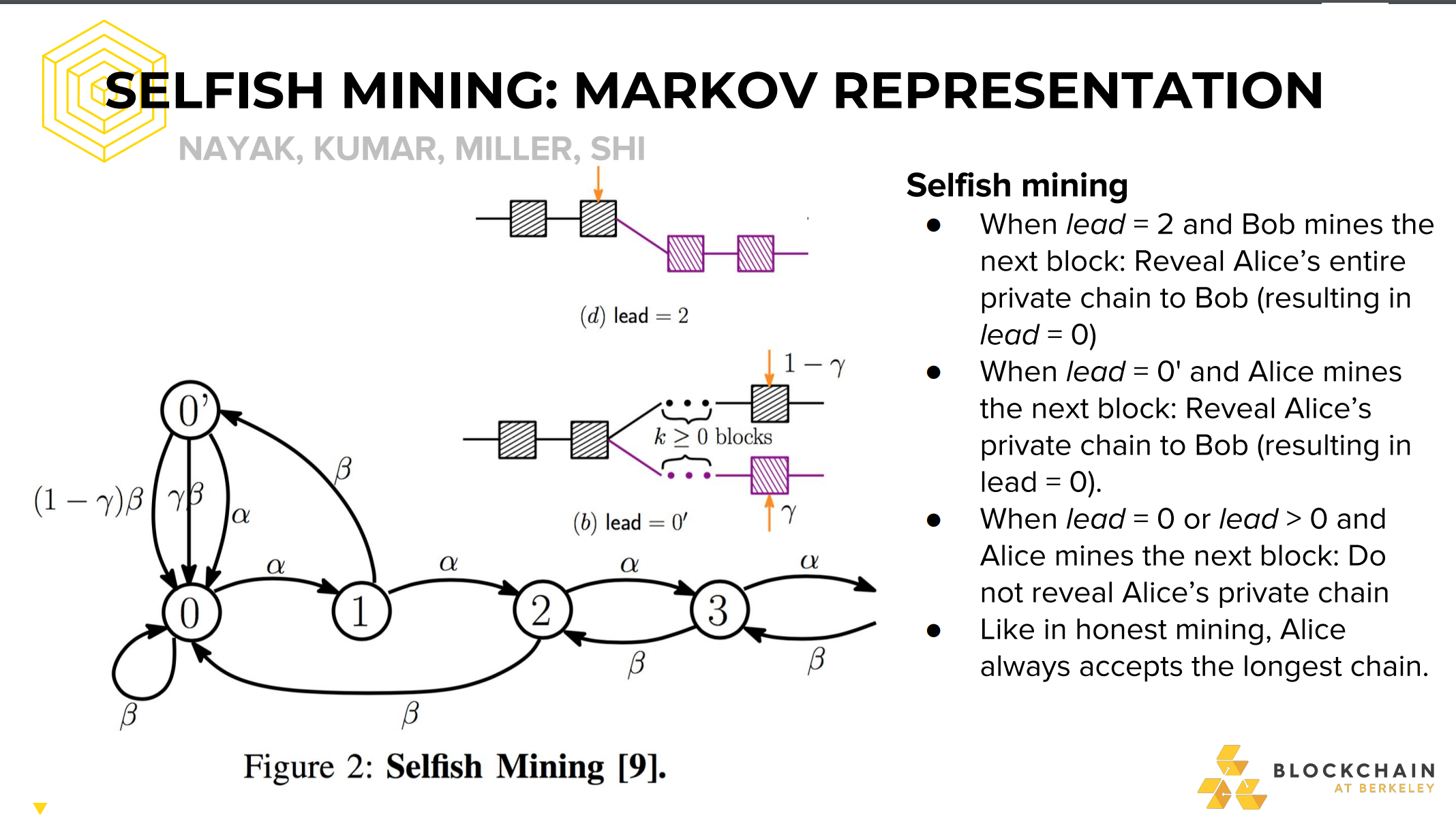

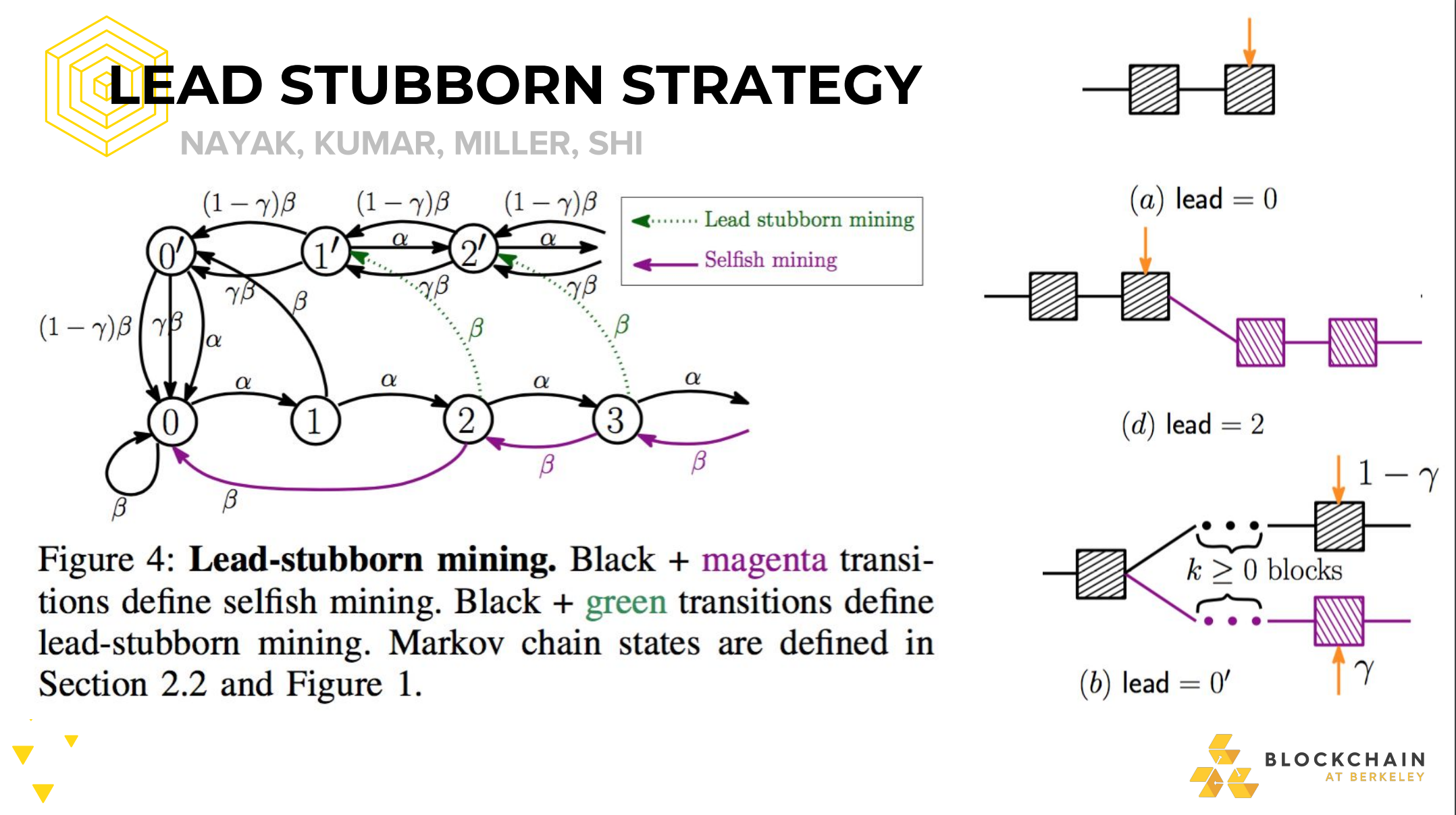

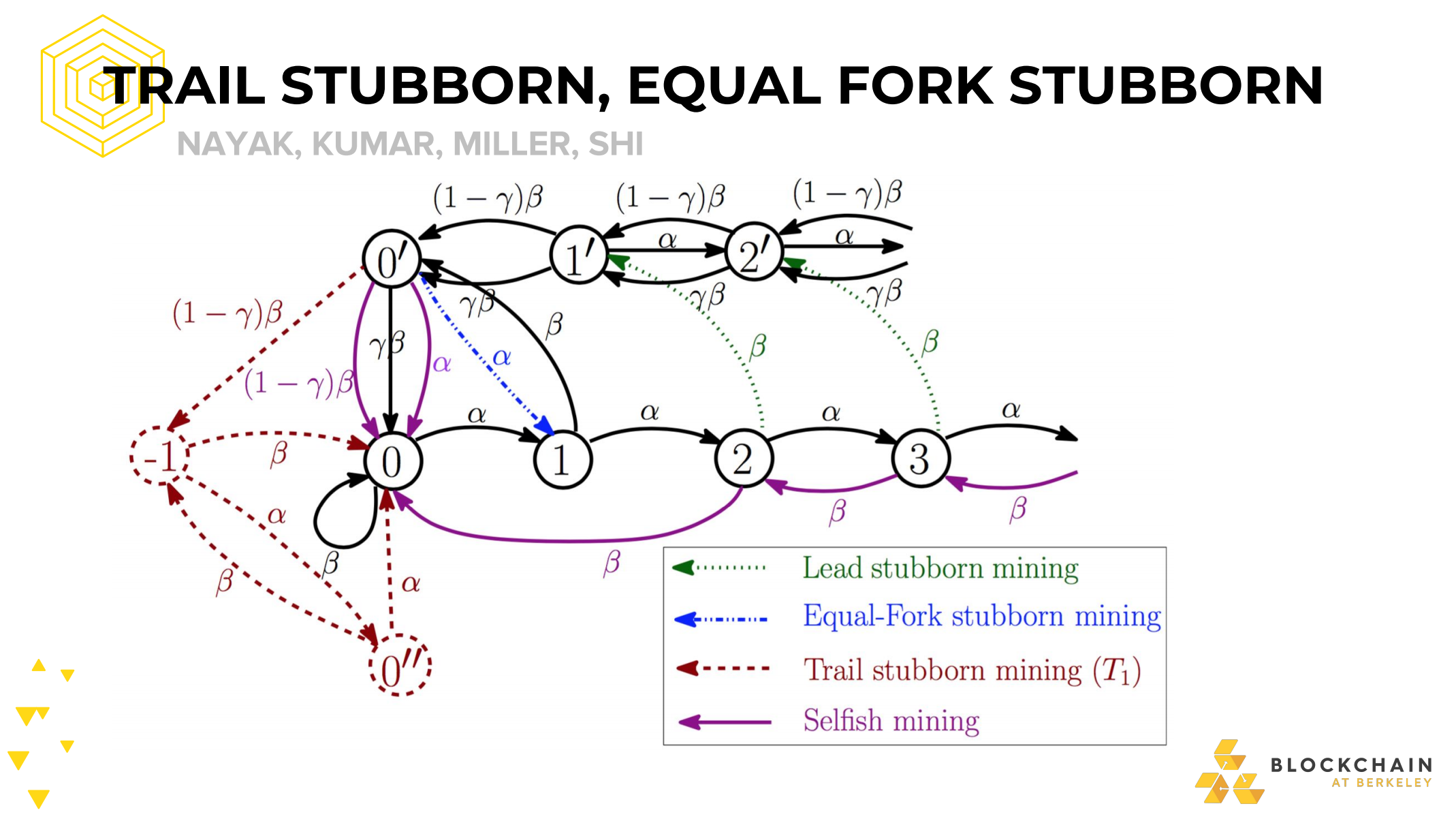

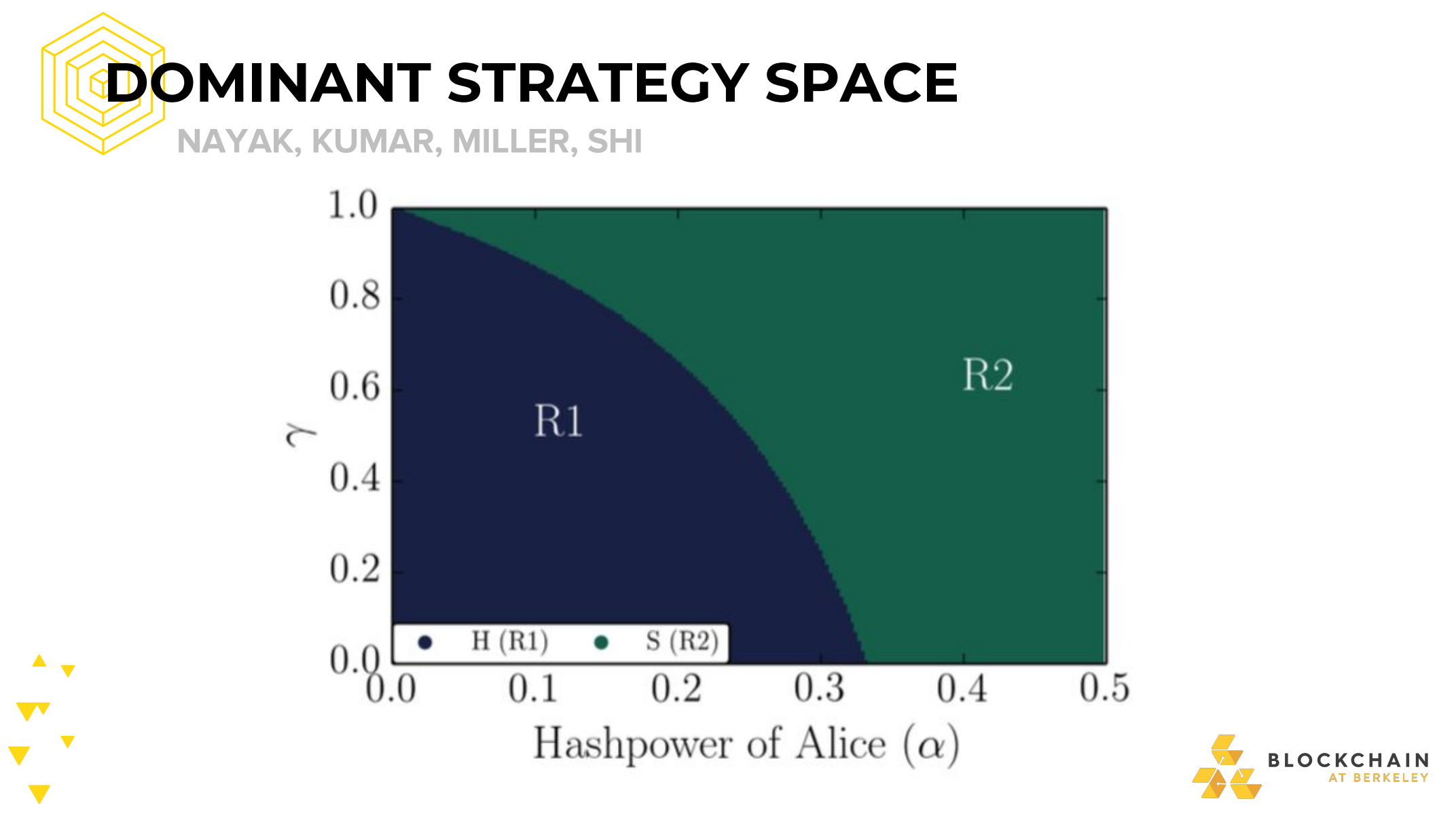

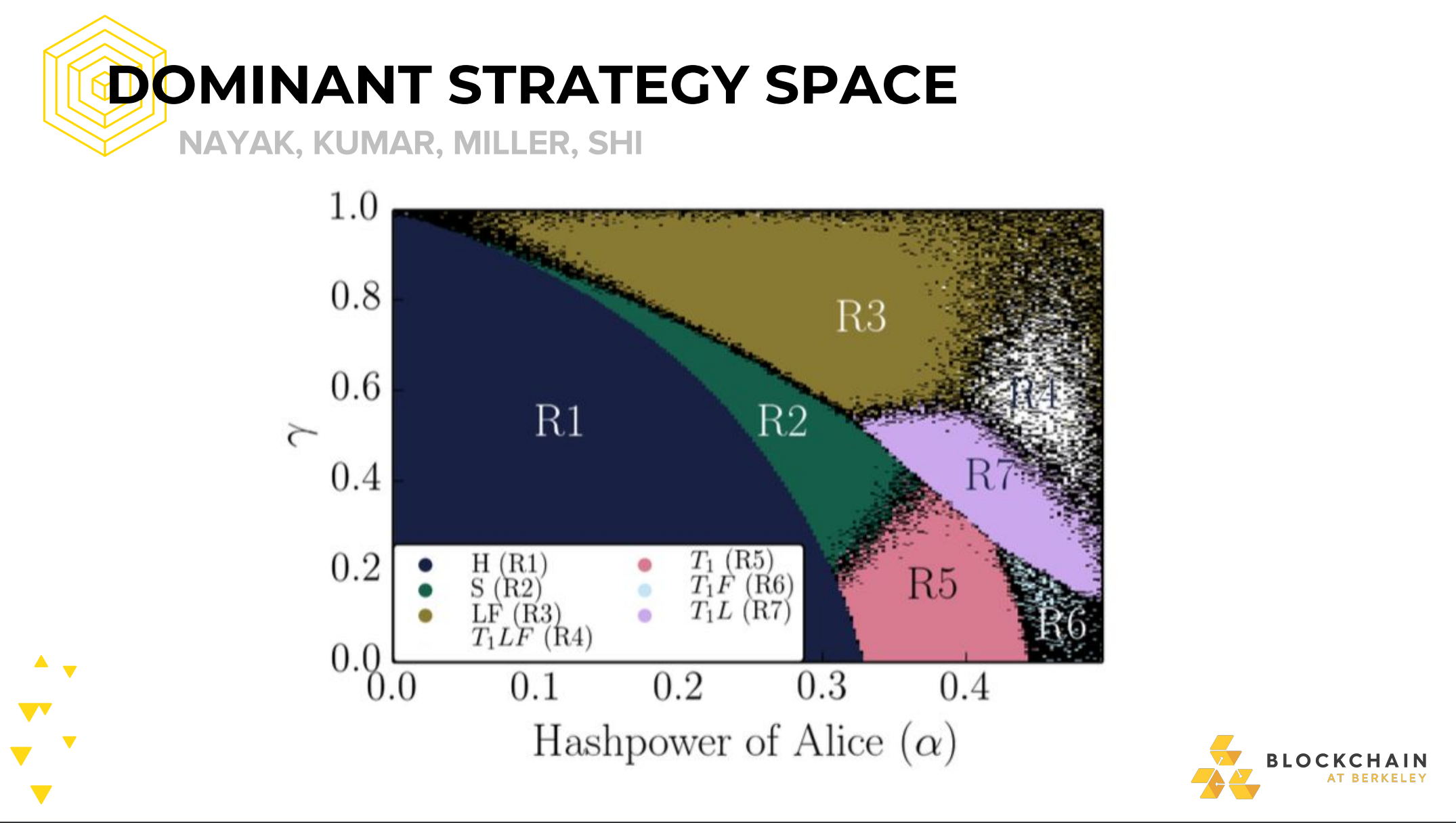

STUBBORN MINING

Generalising selfish mining strategies

-Include block propagation race in our model -Extend selfish mining to include strategies that: -withold blocks longer -attempt to catch up to a longer public chain -are more or less risky with block propagation races

Certain strategies outperform selfish mining

-For different hash rates and block race win rates -Strategy metric: Strategy A > Strategy B if we earn more BTC on average

FORMAL MODEL

Main Variables

- α (Alice): Attacker’s proportion of network hashrate

- β (Bob): Honest network hashrate

- ℽ: Proportion of Bob’s network that will mine on Alice’s block when Alice and Bob have released a block at approximately the same time, resulting in an equal lenght fork

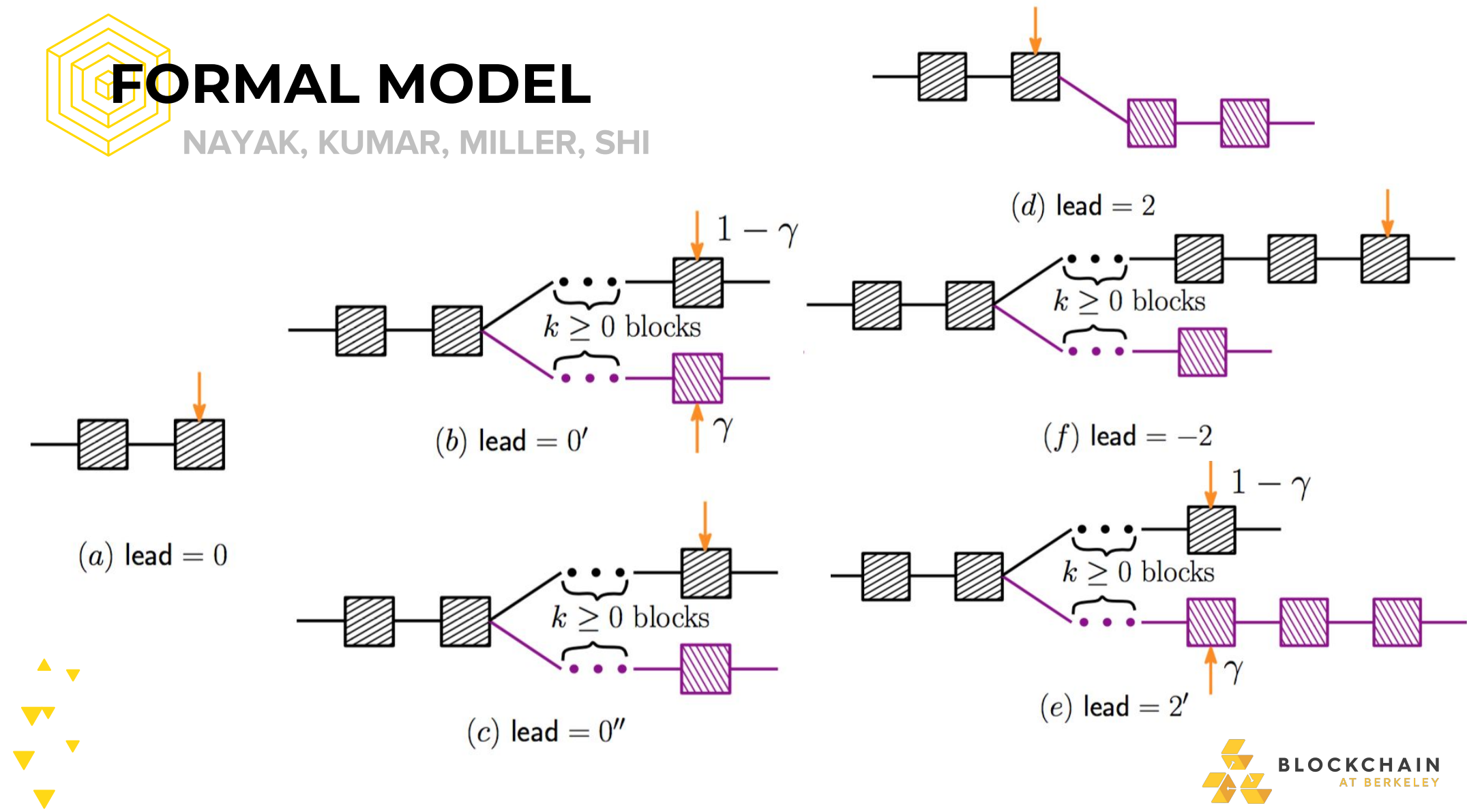

Markov Chain State Representation

- lead: how much Alice’s chain is ahead of Bob’s. Is some integer N

- N’ There is a fork, and

- The revealed portion of the fork is of equal lenght

- Bob’s mining power is split on this fork according to ℽ

- N’‘ Same as N’, but all of Bob’s mining power is on their own fork (i.e ℽ=))

-Selfish Mining Defense

-Game-Theory Based Censorship

-51% Attacks and Collusions

- Incentivizing Double-Spend Collusion in Bitcoin https://www.cs.umd.edu/~gasarch/reupapers/katzbitcoin16.pdf

- Smart Contracts for Bribing Miners http://homepages.cs.ncl.ac.uk/patrick.mccorry/minerbribery.pdf

- Incentivizing Blockchain Forks via Whale Transactions https://www.cs.umd.edu/~jkatz/papers/whale-txs.pdf

- Antbleed https://www.coindesk.com/antbleed-bitcoins-newest-new-controversy-explained/

- https://www.researchgate.net/publication/307507694_Why_Buy_When_You_Can_Rent

- On the Instability of Bitcoin Without the Block Reward http://randomwalker.info/publications/mining_CCS.pdf

- FruitChains: A Fair Blockchain - https://dl.acm.org/citation.cfm?id=3087809

- Eclipse attack vs. Sybil attack https://bitcoin.stackexchange.com/questions/61151/eclipse-attack-vs-sybil-attack

- Eclipse Attacks on Bitcoin’s Peer-to-Peer Network https://eprint.iacr.org/2015/263.pdf

Reference:

https://www.investopedia.com/terms/1/51-attack.asp#ixzz5HVYLPkf3

https://cyber.stanford.edu/sites/default/files/20180124_bpase_game_theoretical_attacks_on_bitcoin.pdf

https://blog.zencash.com/zencash-statement-on-double-spend-attack/